Explore where water-technology investment is growing and how emerging funding priorities are shaping real-world trials and the next wave of scalable solutions.

A roundup of emerging funding priorities in water innovation funding, with examples from technologies already being tested through the Trial Reservoirs Initiative.

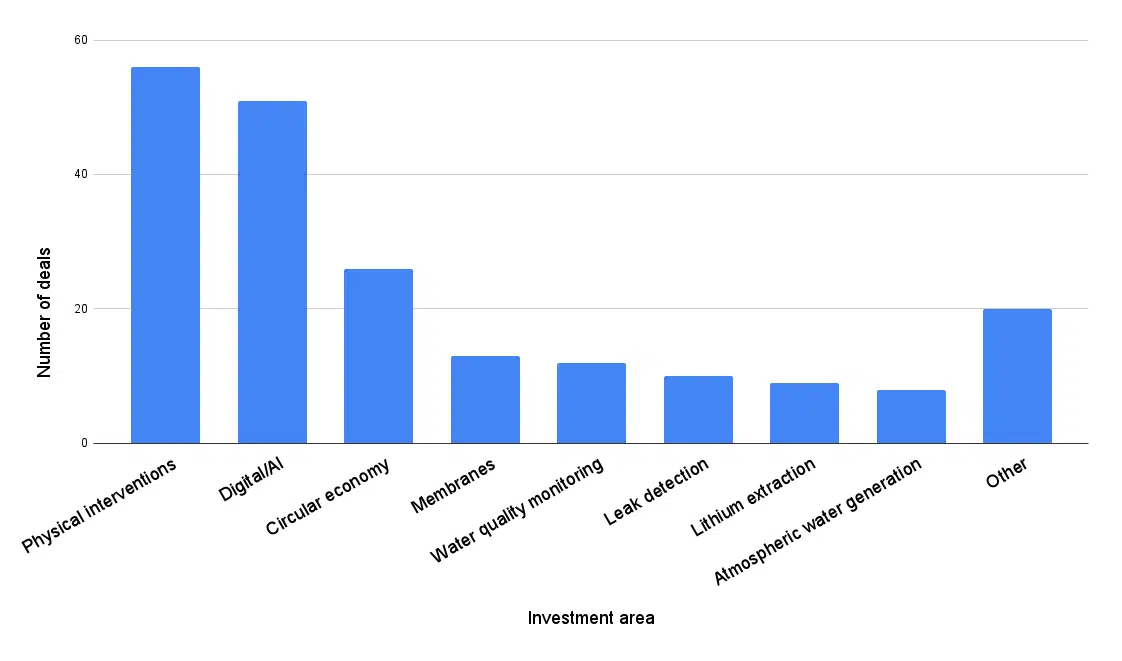

2025 was a remarkably successful year for global water innovation funding. More than $1B USD of third-party capital was committed to water technology vendors in 2025, marking a 20% increase in funding activity across all regions. This surge of investment activity (for the second year running) is a positive indicator for the overall health of the water industry.

2025 saw especially dramatic increases in funding for AI-enabled and digital water solutions, the circular economy, climate change mitigation technologies, and technologies focused on proactive risk mitigation.

The funding in these areas mirrors the types of new trials and pilots we’ve seen enter the Trial Reservoirs Initiative pipeline in 2025. In this blog, we unpack some of 2025’s biggest trending funding areas using case study examples from the Initiative’s portfolio, and cast a glance into the future for where 2026 might take us next.

AI-enabled and digital water solutions

Nearly a quarter of the water-sector funding deals converted in 2025 went towards AI-enabled solutions. The global market for AI in water is forecasted to grow by over 25% in the next seven years, making this one of the fastest evolving technologies within the water sector.

Digital water solutions encompass everything from data management and analytics to automation and controls and the physical sensor network needed to feed data into AI-enabled algorithms. The AI-enabled solutions that garnered interest last year included smart senators for pressure monitoring, real-time flood forecasting, and AI-powered hardware to optimize industrial water use.

Within the Trial Reservoirs Initiative, AInWater’s groundbreaking trial of their Poseidón software showcased the power of digital twins in helping utilities to save energy and costs. Over the course of their 13 month trial at the Bela Vista Wastewater Treatment Plant in Sao Paolo, Brazil, AInWater helped Aegea to achieve a 10% reduction in energy consumption per cubic meter treated. By switching from static operations to real-time AI-drive adjustments, Aegea projects that they can achieve a 20% gain in operational efficiency without compromising on effluent quality.

The circular economy

Comprising just over 10% of the water investment deals closed last year, circular economy technologies comprise a fundamental and growing aspect of the water technology space. The importance of these technologies becomes even clearer when we include investments into selective lithium capture and water recycling.

The water circular economy is built on three core pillars: reducing waste; recovering nutrients, critical minerals, and energy; and regenerating nature within the water cycle. Stepping beyond the traditional extract-use-dispose industrial model, the circular economy framework seeks to close the loop by treating “waste” water as a valuable resource and ensuring that water systems are integrated to reduce losses.

Waterwhelm’s recently-launched trial with Veolia perfectly showcases these principles in action. Their forward osmosis technology uses a safe, inexpensive draw solution to pull water through a semi-permeable membrane using natural osmotic pressure. The draw solution can be recovered and recycled through thermal separation using waste heat, creating a completely closed-loop system. Not only does the system minimize waste, but the reduced osmotic pressures and utilization of onsite waste heat means a nearly 80% reduction in emissions compared to conventional Reverse Osmosis.

Climate change mitigation

The water utility sector is increasingly responding to calls to reduce the carbon footprint of a sector that accounts for 2% of the world’s greenhouse gas emissions. In a 2024 survey conducted by Xylem, more than 75% of the utilities surveyed had set greenhouse gas (GHG) reduction goals that they plan to achieve by 2040 or earlier.

This commitment by utilities is reflected in 2025 water technology investments, where technologies focused on decarbonization and climate change mitigation saw a significant financial boost.

While methane and carbon dioxide emissions remain huge issues for water and wastewater utilities, nitrous oxide (N2O) is a particularly insidious challenge. In sewered sanitation systems, N2O is estimated to account for over 50% of GHG emissions from wastewater treatment. However, it remains challenging to measure and model, meaning that benchmarking for mitigation remains unclear.

In 2025, Cobalt Water completed a trial with PureControl designed to showcase one pathway to deal with this particular problem. Cobalt Water’s N2ORisk DSS platform combines both expert insights and machine learning to help utilities quantify N2O and optimize their operations to eliminate GHG emissions. Their recent PureControl trial, located at the Beaurade Wastewater Treatment Plant in France, enabled a 15% reduction in GHG emissions and significantly reduced the cost of purchased electricity.

Proactive risk mitigation

With aging infrastructure a constant concern, utilities are increasingly aware of the need to work smarter, not harder when it comes to system maintenance. Identifying leaks and pipe failures before they occur makes sense in terms of customer satisfaction and money: utilities can minimize downtime and defer major capital expenditures by practicing proactive asset management.

These proactive asset management systems use a combination of smart sensors and (often) AI-enabled predictive analytics to identify critical failure hotspots. In terms of hardware, non-invasive testing for pipes of different materials, diameters, shapes, and depths is always a challenge.

With hundreds of kilometers of aging asbestos cement transmission mains, proactive asset management is of particular concern to Dutch utility Brabant Water. Their 2025 trial com KenWave tested a vibroacoustic, non-invasive approach to evaluating pipe condition using residual pipe stiffness as a proxy for pipe thickness. The trial successfully confirmed the technology’s reliability and accuracy, saving time and money for Brabant Water by reducing the number of access points and the amount of disruption during their testing process.

Where next?

Trial Reservoirs Initiative continues to see interest in trials across many of these same technology areas. Our current pipeline includes trials associated with non-revenue water, the circular economy, and carbon sequestration among many others. Our Mudanças climáticas Reservatório de teste continues to actively solicit technologies associated with the mitigation of scope 1, 2, and 3 GHG emissions within the water sector. And we increasingly see the embedded use of AI and machine learning across a broad suite of cutting-edge tools and technologies.

As we wrap up Q1, the Trial Reservoirs Initiative looks forward to continuing to engage with technologies accelerating change across the water sector.

To learn more about the Trial Reservoirs Initiative and how you can get involved, contact Jo Burgess ([email protected]).